How Does Klarna Really Make Money? (It’s More Than Just Late Fees)

You see it everywhere. From the Nike checkout page to your favorite indie boutique, that little pink Klarna logo offers a tantalizing proposition: “Buy it now, pay for it later.” For millions of shoppers, it’s a seamless way to get what you want today without emptying your wallet. But it begs a simple, crucial question: if you’re not paying interest, how on earth does Klarna make money?

The answer is a masterclass in modern fintech and a business model that has reshaped the e-commerce landscape. Klarna’s revenue isn’t just one magic trick; it’s a sophisticated ecosystem built around making shopping smoother for you and more profitable for retailers.

Key Takeaways: How Klarna’s Business Model Works

For those who want the answer right away, here’s the bottom line on how Klarna makes its money:

- Main Income Source: Fees paid by over 500,000 merchant partners for each transaction. Retailers pay Klarna because it helps them sell more.

- Consumer Charges: Interest is charged on long-term financing plans, and late fees can apply to missed payments on the popular interest-free options.

- Affiliate Revenue: Klarna acts as a marketing partner, earning commissions for directing shoppers from its app to retail sites.

- Interchange Fees: A small fee is earned from transactions made with the physical Klarna Card.

- Banking Operations: It earns interest on cash deposits held in its European bank accounts.

Now, let’s pull back the curtain and explore each of these pieces in detail.

What is Klarna and How Does it work for Shoppers?

At its core, Klarna is a payments company and a licensed bank originating from Sweden. It sits between you and the merchant, paying the store for your purchase upfront. You then pay Klarna back over time. As of August 2025, Klarna has amassed over 150 million active users globally by offering a range of distinct payment options.

The “Pay in 4” and “Pay in 30” Models

This is the classic, interest-free Klarna experience.

- Pay in 4: Your total purchase is split into four equal, interest-free installments. The first is paid at checkout, and the remaining three are automatically charged to your card every two weeks.

- Pay in 30: You get the goods now and have a full 30 days to pay the entire amount in one go, again, completely interest-free.

These options are Klarna’s bread and butter, designed for everyday purchases and are the primary source of the “how do they make money without interest?” confusion.

Klarna’s Longer-Term Financing Options

For larger purchases, Klarna offers more traditional financing plans. These plans can stretch from 6 to 36 months and, unlike “Pay in 4,” they often come with an annual percentage rate (APR). This is one of the more direct ways Klarna earns from consumers, functioning much like a traditional loan.

Klarna’s Primary Revenue Stream: Merchant Fees

Here is the main answer to the puzzle. Klarna’s biggest source of income comes from the merchants, not the shoppers.

For every transaction processed using its platform, Klarna charges the retailer a fee. This includes a fixed transaction fee plus a variable percentage of the total purchase price. While the exact numbers vary by country and merchant agreement, these fees typically range from 3% to 6%.

Why Merchants Are Willing to Pay Klarna

Why would a retailer give up a slice of their sale? Because Klarna solves some of their biggest problems. Partnering with Klarna has been shown to:

- Increase Conversion Rates: It reduces “sticker shock” and cart abandonment by making the price more manageable.

- Boost Average Order Value (AOV): Shoppers are more likely to buy more items or more expensive items when they can split the cost.

- Attract New Customers: Offering flexible payments attracts younger, tech-savvy shoppers who might not have or want to use a traditional credit card.

In essence, merchants see Klarna’s fee not as a cost, but as an investment in marketing and sales. They are paying for a bigger, more valuable customer base.

How Much Does Klarna Charge Merchants?

The fee structure generally consists of a fixed fee (e.g., $0.30 per transaction) plus a percentage of the sale, often between 3.29% and 5.99%. This is higher than typical credit card processing fees, but retailers justify the cost with the proven uplift in sales and customer loyalty Klarna delivers.

The Role of Interest and Late Fees from Consumers

While merchants are the primary revenue driver, Klarna does earn money directly from consumers in specific situations.

When Does Klarna Charge Interest?

Interest is charged on the long-term financing plans mentioned earlier. When a shopper chooses to pay for a large purchase over several months (e.g., 6-36 months), Klarna discloses an APR, and the interest paid by the consumer becomes a direct revenue source. This is a crucial distinction from its popular interest-free “Pay in 4” option.

The Impact of Late Fees

If you miss a payment on a “Pay in 4” plan, Klarna may charge a late fee. The company has made efforts to make these fees less punitive than traditional credit card penalties, often capping the total fees and sending multiple reminders. While late fees do contribute to revenue, Klarna’s business model is designed to succeed on merchant fees, not to profit from customer misfortune.

Other Key Revenue Streams for Klarna

Klarna’s strategy is diversified. Beyond merchant fees and consumer interest, it has built several other clever ways to generate income.

Interchange Fees from the Klarna Card

Klarna offers a physical card in some markets that allows users to access their payment plans in-store, wherever Visa is accepted. When this card is used, Klarna earns a small “interchange fee” from the transaction, which is paid by the merchant’s bank.

Affiliate Marketing and Referral Commissions

The Klarna app is not just a payment manager; it’s a full-blown shopping discovery platform. It features product listings, deals, and curated collections. When a user discovers a product in the Klarna app and clicks through to purchase it, Klarna earns an affiliate commission from the retailer for driving that sale. This turns their app into a powerful marketing engine and a significant revenue stream.

Interest on Cash Deposits

With a full banking license in several European countries, Klarna can hold customer deposits in savings accounts. Like any bank, it can earn interest on this cash, contributing to its overall financial health.

Does Using Klarna Affect Your Credit Score?

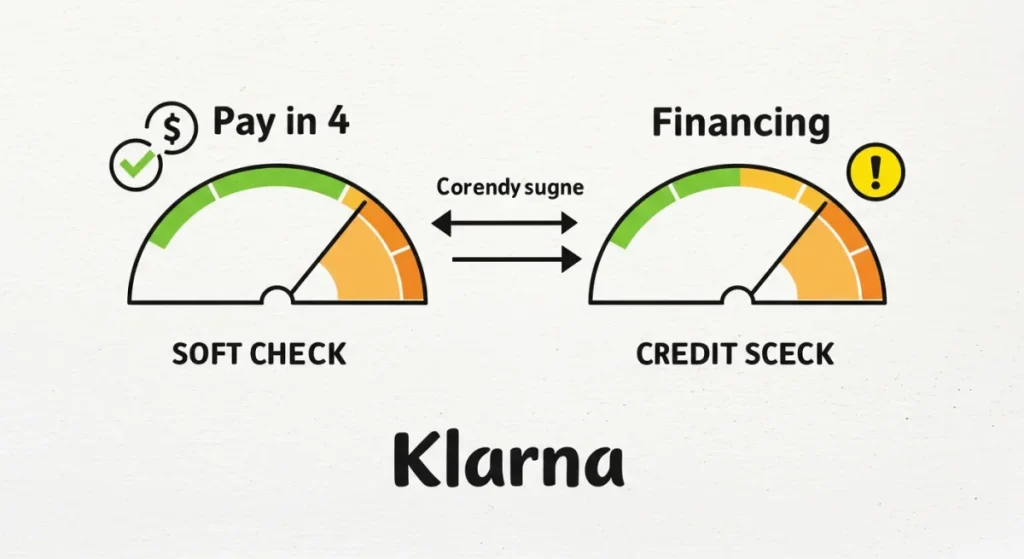

This is a critical question for any responsible consumer. The answer is nuanced.

- Soft vs. Hard Credit Checks: For the “Pay in 4” option, Klarna typically performs only a soft credit check, which is not visible to other lenders and does not affect your credit score.

- Hard Credit Checks: Applying for the longer-term financing plans or the Klarna Card often requires a hard credit check, which is recorded on your credit report and can temporarily lower your score by a few points.

- Reporting to Credit Bureaus: According to a filing with the U.S. Securities and Exchange Commission, Klarna has begun reporting some payment data to credit bureaus. This means on-time payments could potentially help your credit history, while missed payments could hurt it. Always check Klarna’s terms in your specific region.

The Klarna Ecosystem: More Than Just a Payment Method

Understanding Klarna’s revenue requires seeing it as more than a button on a checkout page. It is building a complete shopping ecosystem. The company competes not just with other BNPL providers like Afterpay and Affirm, but also with payment giants like PayPal. By controlling the user experience from product discovery in its app to the final payment, Klarna creates multiple touchpoints for generating revenue, all while gathering valuable data on consumer behavior.

The Klarna App and Shopping Experience

The app is central to this strategy. It’s a shopping browser, a deal finder, and a payment hub rolled into one. By keeping users within its ecosystem, Klarna can maximize its affiliate revenue and strengthen its relationship with both shoppers and merchants.

Klarna’s Role as a Bank

Holding a banking license (as it does in Germany, for example) adds a layer of trust and regulatory oversight. It also unlocks financial tools, like holding deposits, that are unavailable to simple payment processors, providing a more stable financial foundation.

Conclusion: The Future of Klarna and the BNPL Industry

Klarna’s business model is a brilliant response to the evolving demands of modern consumers and retailers. It’s not a simple lender; it’s a technology company that has embedded itself into the very fabric of online shopping. By making the primary cost invisible to most consumers and framing it as a value-add for merchants, Klarna has unlocked explosive growth.

As the BNPL industry faces increasing regulatory scrutiny and competition, this diversified, ecosystem-driven approach will be Klarna’s greatest strength. The company isn’t just betting on you splitting a payment; it’s betting on changing the way you discover, shop, and pay for everything.