How Does Affirm Make Money? A Look Inside the BNPL Giant’s Revenue Streams

You’re Browse online, about to buy that new laptop or mattress, and you see it at checkout: a small logo offering to let you pay over time. It’s Affirm, and it promises a simple way to split your purchase into manageable installments, often with what looks like a magic number: 0% APR.

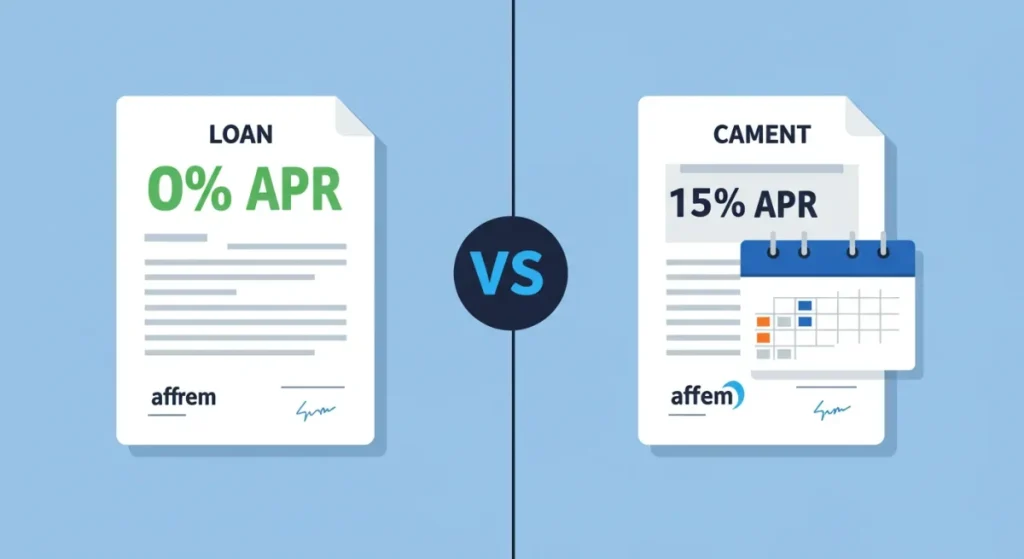

It’s a tempting offer, but it begs a simple, crucial question: if you’re not paying interest, how does Affirm make money?

The answer isn’t a single secret sauce but a sophisticated FinTech business model built on partnerships, data, and a deep understanding of modern e-commerce. As a leader in the “Buy Now, Pay Later” (BNPL) space, founded by PayPal co-founder Max Levchin, Affirm has woven itself into the fabric of online shopping. Its creation can be seen as an evolution of earlier FinTech innovations, building on concepts seen in PayPal’s own business model.

Let’s break down the exact revenue streams that power this BNPL giant.

Key Takeaways

- Primary Income Source: Affirm’s main revenue comes from merchant fees, a percentage of the sale that retailers pay for using its service to increase sales and conversion rates.

- Secondary Income Source: The company also earns interest income from consumers on some loans, though many popular offers are 0% APR.

- A Transparent Model: A core part of Affirm’s strategy is its transparency, offering simple interest with no late fees, which distinguishes it from traditional credit.

- Diverse Revenue Streams: Beyond the basics, Affirm makes money from interchange fees on its virtual card and by selling portfolios of its loans to third-party investors.

- Data-Driven Decisions: The entire business is powered by a sophisticated machine learning engine that assesses credit risk in real-time, enabling instant loan decisions.

What is Affirm and How Does It Work?

At its heart, Affirm offers unsecured installment loans at the point of sale. Instead of paying with a credit card, you choose Affirm and get an instant decision on a loan to cover your purchase.

The Core Concept: Buy Now, Pay Later (BNPL)

BNPL is exactly what it sounds like: a form of short-term financing that allows consumers to make purchases and pay for them at a future date, often in a series of fixed installments. Unlike a credit card’s revolving line of credit, Affirm’s loans are typically for a single purchase with a clear repayment schedule and a fixed total cost.

The User Experience: A Simple Checkout Process

For a shopper, the process is seamless:

- You select Affirm at checkout.

- You enter a few pieces of personal information for a real-time credit decision.

- If approved, you’re shown the loan terms—including the APR (which can be 0%) and the fixed monthly payments.

- You agree to the terms, and the purchase is complete. Affirm pays the merchant for you, and you pay Affirm back over time.

The Role of Lending Partners and Underwriting

Behind that simple interface is a powerful underwriting engine. Affirm uses machine learning and its own data models to assess risk and determine a borrower’s creditworthiness in seconds. It does this in partnership with its originating bank partners, such as Cross River Bank and Celtic Bank, who formally issue the loans. This tech-driven approach allows Affirm to approve more customers than traditional credit models might.

The Primary Revenue Stream: Merchant Fees

The single largest source of Affirm’s revenue doesn’t come from the consumer, especially not on those 0% APR loans. It comes from the merchant.

How Much Does Affirm Charge Merchants?

When a customer makes a purchase using Affirm, the merchant pays Affirm a merchant discount rate (MDR). This is a percentage of the total purchase amount. While the exact fee varies, it’s the core of Affirm’s business model. This is a common practice among payment processors; for instance, the merchant-focused model of Square

Why Do Merchants Partner with Affirm?

Why would retailers like Target and Apple willingly give up a slice of their revenue? The benefits are clear and data-backed:

- Increased Conversion Rates: Offering flexible payment options reduces sticker shock and cart abandonment.

- Higher Average Order Value (AOV): Customers are more likely to buy more expensive items or add more to their cart when they can spread the cost over time.

- Access to New Customers: Affirm can bring in younger shoppers or those without traditional credit who might not have been able to make the purchase.

In short, merchants pay Affirm because Affirm helps them sell more, more often.

The Second Pillar: Interest Income from Consumers

While many promotions are interest-free, not all Affirm loans are 0% APR. The second major revenue source is the interest paid by consumers on certain loans.

How Affirm Makes Money on 0% APR Loans

To be crystal clear: on a 0% APR loan, Affirm makes $0 in interest from the consumer. All the revenue from that specific transaction comes from the fee paid by the merchant. The 0% offer is a powerful marketing tool to encourage sales, and the merchant foots the bill.

Understanding Affirm’s Interest Rates

For loans that aren’t 0%, Affirm charges simple interest, not compound interest. This means you pay interest on the original loan amount, and the interest never accumulates on itself. Rates can vary, but Affirm prides itself on transparency: the total amount of interest you’ll pay is shown upfront before you commit to the loan.

The “No Late Fees” Promise

A key differentiator for Affirm is its “no late fees” policy. Unlike credit cards or some competitors, Affirm does not charge penalties for late payments. While this is a consumer-friendly feature, it also puts the onus on their underwriting model to approve customers who are likely to pay on time.

Other Revenue Streams Fueling Affirm’s Growth

Beyond merchant fees and consumer interest, Affirm has developed other ways to generate income.

- Interchange Fees from the Affirm Card: Affirm offers a virtual card that allows users to pay in installments almost anywhere, even at merchants not directly integrated with Affirm. For these transactions, Affirm earns a small interchange fee from the card payment network.

- Selling Loans to Third-Party Investors (Securitization): Affirm doesn’t hold all the loans it originates on its own books. The company packages many of these loans and sells them to third-party investors and financial institutions. This provides Affirm with immediate capital to fund new loans and transfers some of the risk.

- Servicing Income: When Affirm sells a loan, it often continues to manage the loan on behalf of the investor (collecting payments, handling customer service). For this, it earns a servicing fee.

Affirm’s Business Model: A Holistic View

Affirm’s model is a three-sided network that creates a symbiotic relationship.

- Consumers get flexible, transparent financing.

- Merchants get more sales and higher order values.

- Affirm facilitates the transaction, taking a fee from the merchant and/or interest from the consumer, while managing risk through its advanced data and machine learning algorithms.

Affirm vs. Competitors: How Does it Compare?

The BNPL space is crowded. Understanding Klarna’s revenue strategy or the business model behind Afterpay shows slight variations on the same theme.

- Affirm vs. Klarna: Both offer a wide range of payment plans. Affirm focuses heavily on simple interest and transparent terms with no hidden fees, while Klarna offers a broader range of services, including a shopping app and rewards.

- Affirm vs. Afterpay: Afterpay’s classic model is “pay in 4” interest-free installments. A key difference is that Afterpay has historically charged late fees (though this is changing in some models), whereas Affirm never does.

The Risks and Challenges to Affirm’s Profitability

Despite its massive growth, the path for Affirm isn’t without obstacles.

Has Affirm Made a Profit?

This is a key question for investors. Like many high-growth tech companies, Affirm has historically prioritized expansion and market share over short-term profitability. According to its public financial filings with the SEC, the company has reported significant net losses as it invests heavily in technology, marketing, and loan loss provisions.

Regulatory Scrutiny in the BNPL Space

As the BNPL industry has boomed, it has attracted the attention of regulators. Government bodies like the Consumer Financial Protection Bureau (CFPB) are examining the industry’s practices to ensure consumers are adequately protected, which could lead to new rules that impact Affirm’s business model.

The Impact of Delinquency Rates

Affirm’s profitability is directly tied to its ability to predict who will pay them back. If more customers default on their loans (an increase in the delinquency rate), Affirm’s losses increase. This makes their underwriting technology a critical component of their financial health.

Frequently Asked Questions (FAQ)

What is the downside of using Affirm?

The primary downside is that you are taking on debt. While Affirm is transparent, financing can encourage overspending. Additionally, interest rates on non-0% APR loans can be high depending on your credit.

Does Affirm affect your credit score?

Yes, it can. Affirm may perform a “soft” credit check to pre-qualify you, which doesn’t impact your score. However, if you accept a loan, Affirm may report your payment history to credit bureaus like Experian. Making payments on time can help build your credit, while late or missed payments can damage it.

Can I pay Affirm off early?

Yes. Affirm allows you to pay off your loan at any time without any prepayment penalties. Because Affirm uses simple interest, paying early will also reduce the total amount of interest you pay.

Conclusion: The Future of Affirm and the BNPL Industry

Affirm doesn’t make money from one single source. It operates a complex and diversified business model centered on providing value to both merchants and consumers. By charging fees to merchants for driving sales and earning interest from consumers on longer-term loans, Affirm has established itself as a cornerstone of modern e-commerce.

The company’s future success will depend on its ability to navigate increasing competition, manage credit risk through its powerful machine-learning technology, and adapt to a changing regulatory landscape. But for now, every time you see that little logo at checkout, you’ll know exactly what’s happening behind the scenes.